When to Worry About Veins That Appear Out of Nowhere

Low Body Fat: When body fat reduces, especially in the limbs or torso, the layer of fat that usually hides veins becomes thinner, making them more visible.

Exercise and Weight Lifting: Increased blood flow during exercise can make veins to swell and become more noticeable. Over time, with regular training, muscles grow and push the veins closer to the surface.

Hot Weather: Warm temperatures cause veins to dilate (widen) as the body tries to cool itself. This temporary change can make them more visible, especially in the arms and legs.

Aging: As we age, our skin removes elasticity and becomes thinner. This allows underlying structures like veins to show through more easily.

see moreZohran Mamdani Appears Shaken Following Trump’s Latest Response

NEW YORK — Progressive mayoral candidate Zohran Mamdani appeared unsettled this week after former President Donald Trump issued a direct and pointed statement criticizing his campaign, sparking a wave of media attention and political speculation. The exchange highlights the growing intensity of New York City’s mayoral race and the way national figures are influencing local elections.

The incident unfolded after Mamdani, widely regarded as a rising star of the progressive wing of the Democratic Party, delivered a series of speeches outlining his ambitious platform. His proposals include rent stabilization reforms, enhanced public housing programs, and major environmental initiatives aimed at reducing the city’s carbon footprint. While these policies have energized younger voters and progressives, they have also drawn sharp criticism from conservative commentators who label his platform as overly radical.

Trump, in a public statement via social media and press outlets, condemned Mamdani’s proposals as “a socialist takeover” that would “bankrupt New York and drive families and businesses out of the city.” He urged voters to consider the potential consequences of Mamdani’s agenda, claiming that a Mamdani administration would lead to higher taxes, reduced public safety, and economic instability. The statement has been widely circulated online, with clips trending on multiple platforms and drawing attention from both national and local audiences.

Following Trump’s statement, Mamdani’s campaign faced immediate pressure. While the candidate remained outwardly composed in public appearances, insiders report a sense of unease within his team. Campaign aides confirmed that Mamdani is reassessing messaging strategies and voter outreach plans to counteract the negative framing presented by Trump’s comments. “We knew the national spotlight would come at some point,” one aide said, “but the intensity of the reaction has definitely forced us to rethink how we communicate our platform to a broader audience.”

Political analysts suggest that Trump’s intervention reflects a broader strategy to influence local elections by positioning progressive candidates as radical threats. “This is about optics and framing,” said Dr. Karen Whitfield, a political science expert. “By labeling Mamdani as a dangerous socialist, Trump is trying to mobilize conservative and moderate voters, not just in New York, but nationally, to pay attention to local races.”

The interaction also underscores the increasing nationalization of municipal elections. Candidates like Mamdani, who are pursuing ambitious progressive agendas, are finding themselves subject to scrutiny from figures and media outlets far beyond city limits. While this can boost name recognition, it also exposes them to attacks that can shift public perception quickly.

Despite the pressure, Mamdani’s campaign continues to focus on grassroots organizing and community engagement. Supporters argue that the criticism from Trump may energize progressive voters and increase turnout among younger demographics who see Mamdani as a bold alternative to traditional city leadership.

As the race progresses, the question remains whether Mamdani can maintain momentum in the face of high-profile opposition. One thing is clear: the New York mayoral race is no longer just a local contest. With national figures weighing in, the stakes have never been higher, and Zohran Mamdani’s ability to withstand political pressure will likely shape both his campaign and the broader narrative of progressive politics in urban America.

Florida must stay the course to pay for promised pension benefits

Florida’s retirement system for public workers is estimated to be 17 years away from eliminating expensive pension debt.

Florida’s retirement system for public workers, which covers most of the state’s teachers, police, firefighters, and other government employees, is estimated to be 17 years away from eliminating expensive pension debt. However, this result will depend significantly on market outcomes. A recession during that period could undo years of progress and drive up costs for government budgets and taxpayers. Lawmakers in the Sunshine State need to stay the course and resist the temptation to add to pension promises while they remain several years away from being able to fund existing promises fully.

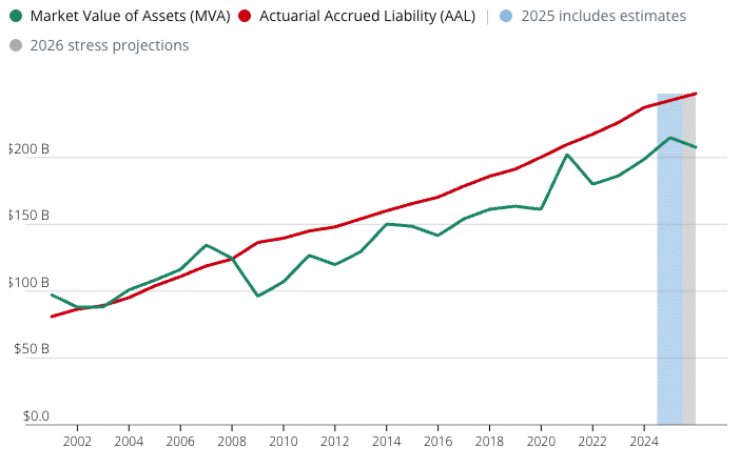

A new analysis by Aon Investments USA Inc. (a market consulting company), commissioned by the Florida State Board of Administrators (SBA), predicts that the Florida Retirement System, FRS, is on track to eliminate all unfunded pension liabilities by 2042. Lawmakers reformed the system in 2011 by introducing a defined contribution (DC) option called the Investment Plan, and subsequently made it the default retirement plan for most new hires in 2018. These reforms have helped FRS make progress in closing what was a nearly $40 billion funding shortfall after the Great Recession.

The latest reporting from FRS now gives the system an 83.7% funded ratio (up from 70% in 2009), indicating that the state has made progress but still needs to stay the course to return to its pre-recession, full funding status. According to Reason Foudnation’s recently released Annual Pension Solvency and Performance Report, one bad year in the market (0% returns in 2026) would essentially undo that progress, bringing the system’s unfunded liabilities back to an estimated $40 billion overnight.

Florida has a long way to go before catching up with its public pension promises  Source: Reason’s Annual Pension Solvency and Performance Report, using FRS annual valuation reports.

Source: Reason’s Annual Pension Solvency and Performance Report, using FRS annual valuation reports.

If market outcomes over the next two decades resemble those of the last 20 years, FRS won’t achieve full funding anytime soon. The pension system’s 24-year average return since 2001 is 6.4%, falling short of the plan’s 6.7% assumption. According to Reason Foundation’s actuarial modeling of FRS, this seemingly small 0.3% shortfall would push the date for reaching full funding out by another three years.

Another major recession would also significantly derail the system. Reason Foundation’s modeling indicates that an investment loss in 2026 similar to that of 2009 (a 20% loss) would result in a funding ratio of 62%, and it would take 15 years just to climb back to today’s funding levels. The full funding date would extend well beyond 2055 in that scenario.

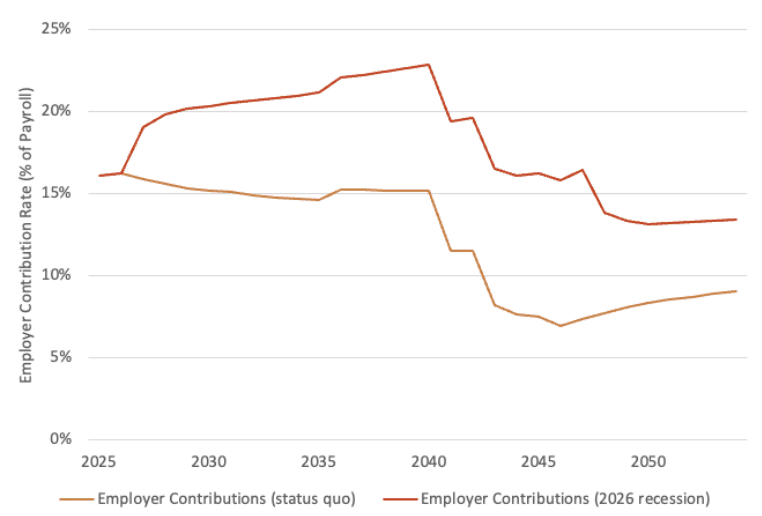

Lower market returns would also drive up the annual costs of FRS, which taxpayers and lawmakers should be wary of. In 2024, employers contributing to the FRS pension paid an amount equal to around 12.7% of payroll (totaling $5.6 billion statewide annually). If everything goes as planned, with returns matching the system’s assumptions, this cost will remain relatively stable and drop significantly once the system is free from pension debt. Under the scenario of a major recession, annual costs will need to rise to as high as 22.9% of payroll to maintain full pension benefit payments.

A recession would necessitate much larger government contributions  Source: Reason actuarial modeling of FRS. Recessions use return scenarios reflective of Dodd-Frank testing regulations.

Source: Reason actuarial modeling of FRS. Recessions use return scenarios reflective of Dodd-Frank testing regulations.

When it comes to public pensions, policymakers can hope for the best, but they need to prepare for the worst. At a minimum, they should structure pension systems to withstand the same market pressures and funding challenges that created today’s costly pension debt.

Florida lawmakers should consider these risks as they weigh proposals to expand benefits. During the 2025 legislative session, lawmakers saw (and rejected) a proposal to unroll the state’s crucial 2011 reform by again granting cost-of-living adjustments (COLAs) to all FRS members.

Reason Foundation’s analysis of the proposal warned that even under a best-case scenario, the move would add $36 billion in new costs over the next 30 years. A scenario in which the system sees multiple recessions over the next 30 years would have driven the estimated costs of the proposed COLA to $47 billion.

For a pension fund that is still many years away from having the assets to fulfill existing retirement promises, the last thing it needs is to double down on more costs and liabilities.

Current proposals to cut taxes in the Sunshine State should also factor into any consideration of granting additional pension benefits to public workers. A new group of bills introduced in the state’s House of Representatives signals that lawmakers intend to offer several property tax-cutting measures to voters on the 2026 ballot. It is safe to say that the idea of increasing pension costs on Florida’s local governments while simultaneously facing the prospect of reduced tax revenue is ill-advised.

Through prudent reforms, Florida has made some laudable progress in improving the funding of its public pension system. However, the state is still several years away from achieving the end goal of all these efforts, and any level of market turbulence would push the finish line out by decades. Policymakers need to be aware of Florida’s long-term pension funding strategy and avoid any proposals to add to the costs and risks imposed on taxpayers through new pension benefits.